This Week: Inflation & labor data in focus!

- EURUSD, US500, USDInd & CAD in focus

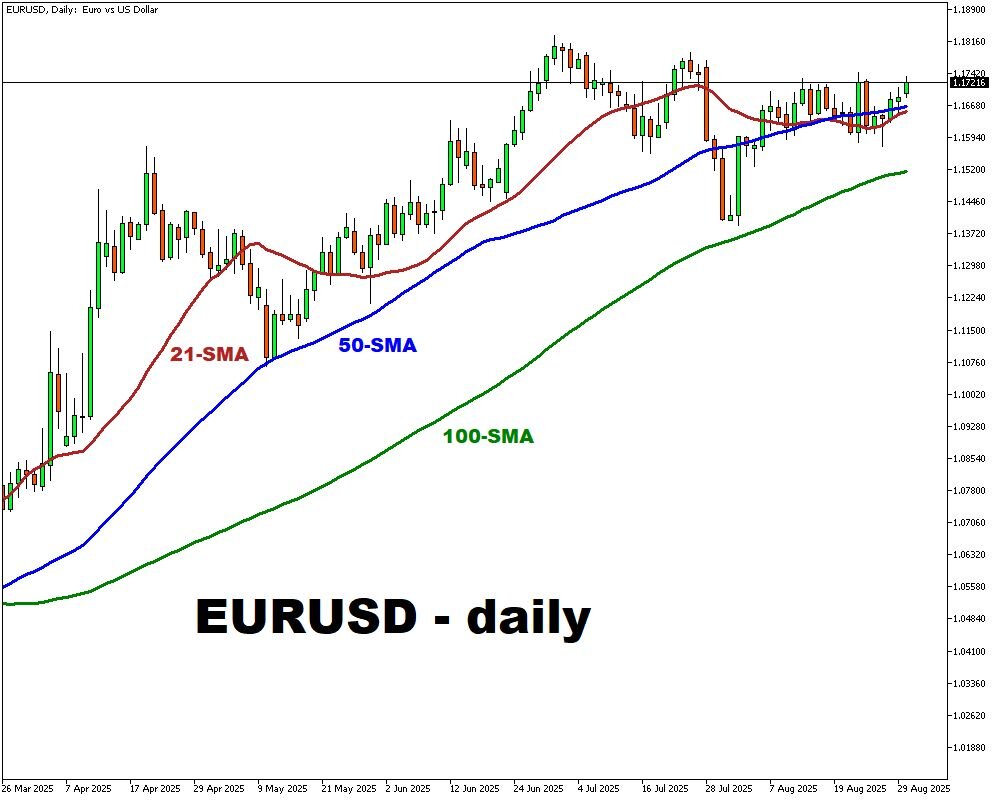

- Eurozone inflation eyed for EURUSD direction

- US payrolls key for Fed path, USD, and US500

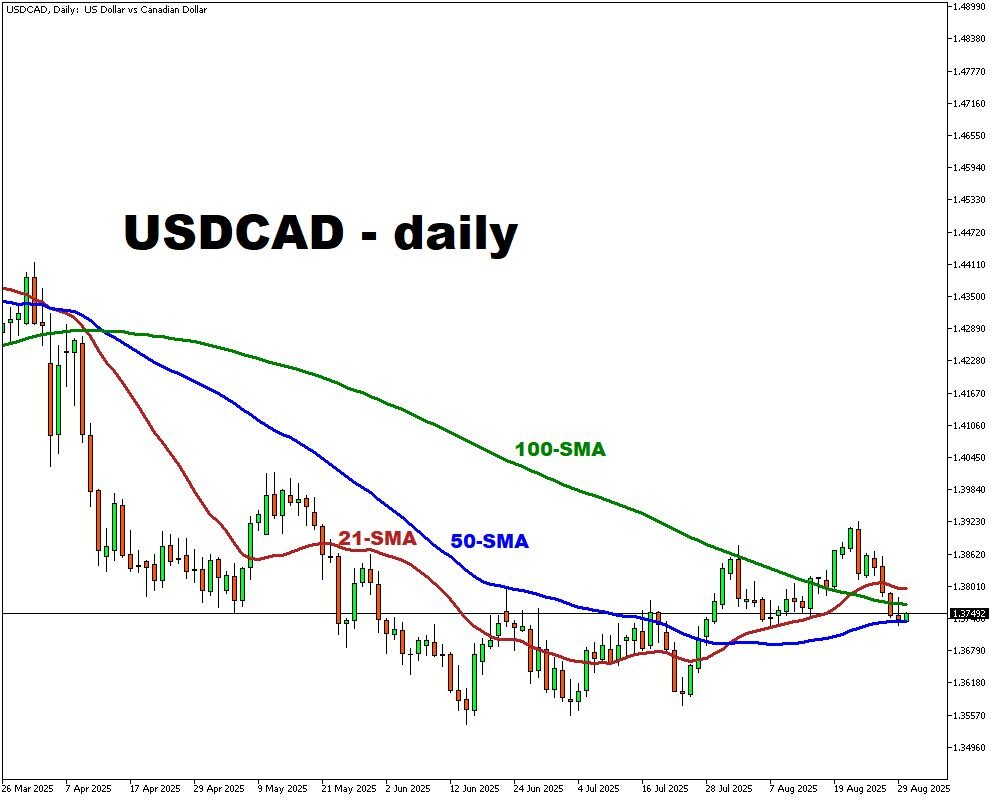

- Canada jobless data to steer CAD this week

This Week: Inflation, labor data, and CAD in focus!

A high-stakes week lies ahead for traders as inflation and labor market data take center stage. The Eurozone’s inflation report will be the first test, potentially steering EURUSD.

In the US, Non-Farm Payrolls will dominate market attention, offering critical insight into labor strength and the Fed’s policy path, with potential spillover effects on USD and US500 index. Finally, Canada’s unemployment rate will provide an important gauge for CAD.

Events Watchlist:

Tuesday, September 2nd: Eurozone Inflation – EURUSD

Inflation remains the key swing factor for the ECB. A hotter print could revive hawkish bets, potentially sending EURUSD higher. Conversely, a weaker number would reinforce dovish expectations, potentially weighing on the pair.

Friday, September 5th: US Non-Farm Payrolls – US500 Index & USD

The marquee event of the week. A strong report above forecasts would bolster the USD, potentially weighing on equities and pulling the US500 lower. A downside miss may fuel risk-on sentiment, boosting equities and softening the dollar.

Friday, September 5th: Canada Unemployment Rate – CAD crosses

With CAD under pressure, labor data will be crucial. Rising unemployment could deepen losses in CAD crosses, especially versus USD. A stronger print may stabilize the loonie and offer relief against recent pressure.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, Sep 1

- US Labor Day: US Markets Are Closed

- CNY: China Caixin Manufacturing PMI (Aug)

- SPN35: Spain HCOB Manufacturing PMI (Aug)

- CHF: Swiss Manufacturing PMI (Aug); Retail Sales (Jul)

- GBP: BoE Consumer Credit (Jul); Mortgage Approvals (Jul); Mortgage Lending (Jul)

- EUR: EU Unemployment rate (Jul)

Tuesday, Sep 2

- EUR: Eurozone Inflation Rate (Aug)

- CAD: Canada S&P Global Manufacturing PMI (Aug)

- USD: US ISM Manufacturing PMI (Aug)

Wednesday, Sep 3

- AUD: Australia GDP

- CNY: China Caixin Services PMI (Q2)

- SPN35: Spain HCOB Services PMI (Aug)

- US500: US JOLTs Job Openings (Jul)

- WTI: US API Crude Oil Stock Change (w/e Aug 29)

Thursday, Sep 4

- AUD: Australia Balance of Trade (Jul)

- CHF: Swiss Inflation Rate (Aug); Unemployment Rate (Aug)

- EZ: Eurozone Retail Sales (Jul)

- CAD: Canada Balance of Trade (Jul)

- NAS100: US ISM Services PMI (Aug); Initial Jobless Claims (w/e Aug 29)

- JPY: Japan Household Spending (Jul)

Friday, Sep 5

- GER40: Germany Factory orders (Jul)

- UK100: UK Retail Sales; Halifax House Price Index (Jul)

- CHF: Swiss Consumer Confidence (Aug)

- CAD: Canada Unemployment Rate (Aug); Ivey PMI s.a (Aug)

- USD: US Non-Farm Payrolls; Unemployment Rate (Aug); Average Hourly Earnings (Aug)