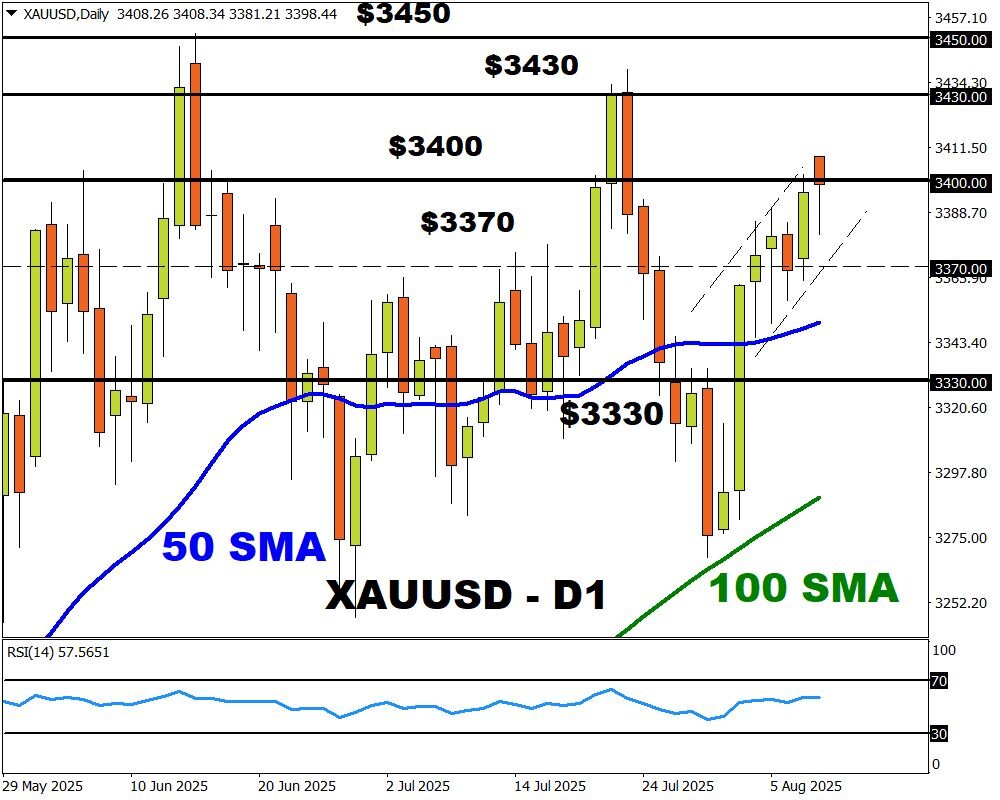

Gold to extend gains toward $3450?

- Gold headed for weekly gain amid tariff uncertainty

- US CPI + US-China truce expiration might spark volatility

- Precious metal bullish but $3400 needs to be conquered

- Key levels of interest $3430, $3400 and 50-day

Gold is on track for its biggest weekly climb in a month thanks to tariff related uncertainty and expectations around lower US rates.

The precious metal jumped in the early hours of Friday after a Financial Times report said that the United States imposed import tariffs on gold bars from Switzerland, according to a so-called ruling letter dated July 31.

Given how these tariffs may disrupt the supply chain and potentially reduce the available supply, prices may push higher as investors react to potential scarcity.

In the week ahead, gold’s outlook may be influenced by the incoming US CPI report and the expiration of a preliminary US-China trade truce.

- Any signs of rising inflation pressure in the United States may hit Fed cut bets, weighing on gold prices.

- A 90-day trade truce between the US and China expires on Tuesday. Without an extension, the US could reimpose 145% tariffs on Chinese goods, while Beijing might reinstate 125% duties on US goods. If this becomes reality, risk aversion may send investors rushing toward gold.

Tuesday’s double risk cocktail may inject gold with heightened levels of volatility.

Talking technicals

- A strong weekly close above $3400 may encourage a move toward $3430 and $3450.

- Weakness below $3400 could open a path back toward $3370 and the 50-day SMA.

Gold