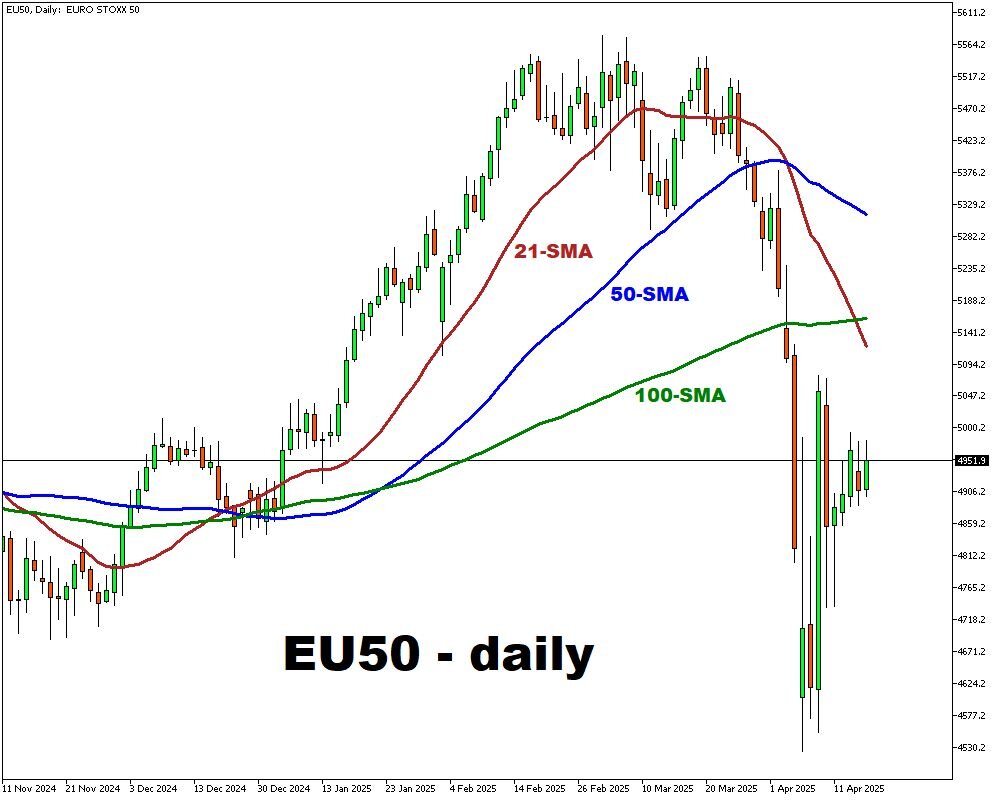

EU50 Index rebounds ahead of ECB rate decision

- EU50 edges higher ahead of ECB rate decision

- ECB poised for sixth rate cut since June

- Rate cut to 2.25% aims to ease slow growth

- Trade tensions threaten Eurozone outlook

- ECB may be ready to act again if risks persist

The EU50 index rises on Thursday as investors assess corporate earnings and anticipate a potential rate cut from the European Central Bank.

The index reflects lingering caution amid trade tensions and monetary policy uncertainty.

Markets are closely watching the ECB, which is widely expected to deliver a 25-basis-point cut – its sixth consecutive reduction since June – lowering the deposit rate to 2.25%, the upper bound of its neutral range.

The move underscores the central bank’s efforts to counter slowing growth, subdued inflation, and external risks, including US trade tariffs.

ECB President Christine Lagarde has cautioned that escalating trade disputes could slash the Eurozone’s already modest growth forecasts.

Although a temporary pause in EU-US tariffs has provided some relief, persistent uncertainty continues to dampen business investment and consumer sentiment.

Reaffirming its commitment to stability, the ECB has signaled a readiness to take further action if needed, reinforcing the market’s defensive stance.